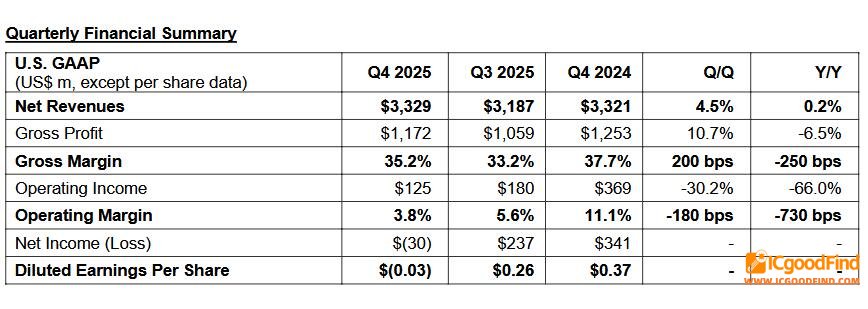

STMicroelectronics reported its Q4 2025 and full-year financial results, showing a clear path to recovery. However, weakness in its automotive chip business remains a significant challenge. For Q4 2025, net revenues were $3.33 billion with a gross margin of 35.2%. Full-year 2025 net revenues reached $11.8 billion.

The company forecasts Q1 2026 revenues of around $3.04 billion, indicating a continued recovery. CEO Jean-Marc Chery noted that Q4 performance exceeded expectations, driven primarily by growth in personal electronics, followed by contributions from consumer and industrial segments. In contrast, the automotive business underperformed, acting as a drag on growth due to global inventory adjustments and a slowdown in electric vehicle adoption.

STMicro's 2025 was a story of recovery from a cyclical trough in Q1 to a return to year-over-year growth by Q4. This rebound aligns with a broader industry upswing. WSTS data projects the global semiconductor market to grow significantly, reaching nearly $1 trillion by 2026. While AI-driven logic and memory chips lead, traditional segments like MCUs and analog chips are also poised for a strong recovery.

This broader recovery is signaled by peers like Texas Instruments, which reported strong Q4 results with particular strength in its data center segment, suggesting a pickup in industrial and automotive demand alongside sustained AI infrastructure investment.

ICgoodFind : STMicro's Q4 rebound aligns with the broader sector recovery, yet its continued automotive segment weakness highlights the uneven demand across different semiconductor markets. This divergence is likely to persist in the near term.